Overview

The article highlights how flooring businesses can leverage simple invoicing software to streamline their billing processes effectively. By identifying specific business needs and evaluating essential features, companies can ensure that the software integrates seamlessly with existing tools. This integration is crucial for enhancing efficiency and managing cash flow effectively.

Consider this: Did you know that businesses that adopt invoicing software can see a significant improvement in their billing accuracy and speed? Statistics show that companies utilizing such tools often experience faster payment cycles and reduced administrative costs. This is not just about convenience; it’s about transforming your operational efficiency.

To truly benefit from invoicing software, flooring businesses must focus on a few key aspects:

- Assess your unique requirements. What features are essential for your operations?

- Ensure that the software can integrate with your current systems. This capability is vital for maintaining workflow continuity and maximizing productivity.

In conclusion, adopting invoicing software is not merely a trend; it’s a strategic move that can lead to substantial improvements in your business operations. By taking the time to evaluate your needs and choosing the right software, you can enhance your billing processes, improve cash flow management, and ultimately drive your business forward. Don’t wait—explore your options today and see the difference it can make.

Introduction

In the competitive landscape of the flooring industry, efficient invoicing can significantly impact a business's cash flow and customer satisfaction. Flooring companies that master simple invoicing software can streamline their billing processes, reduce errors, and ultimately enhance profitability. But with a myriad of software options available, how can businesses determine which features truly align with their unique needs?

This guide delves into the essential considerations for selecting the right invoicing solution. By understanding these factors, flooring businesses can not only keep pace but thrive in an increasingly digital marketplace. Let's explore how the right invoicing software can transform your operations and set you on the path to success.

Identify Your Business Needs for Invoicing Software

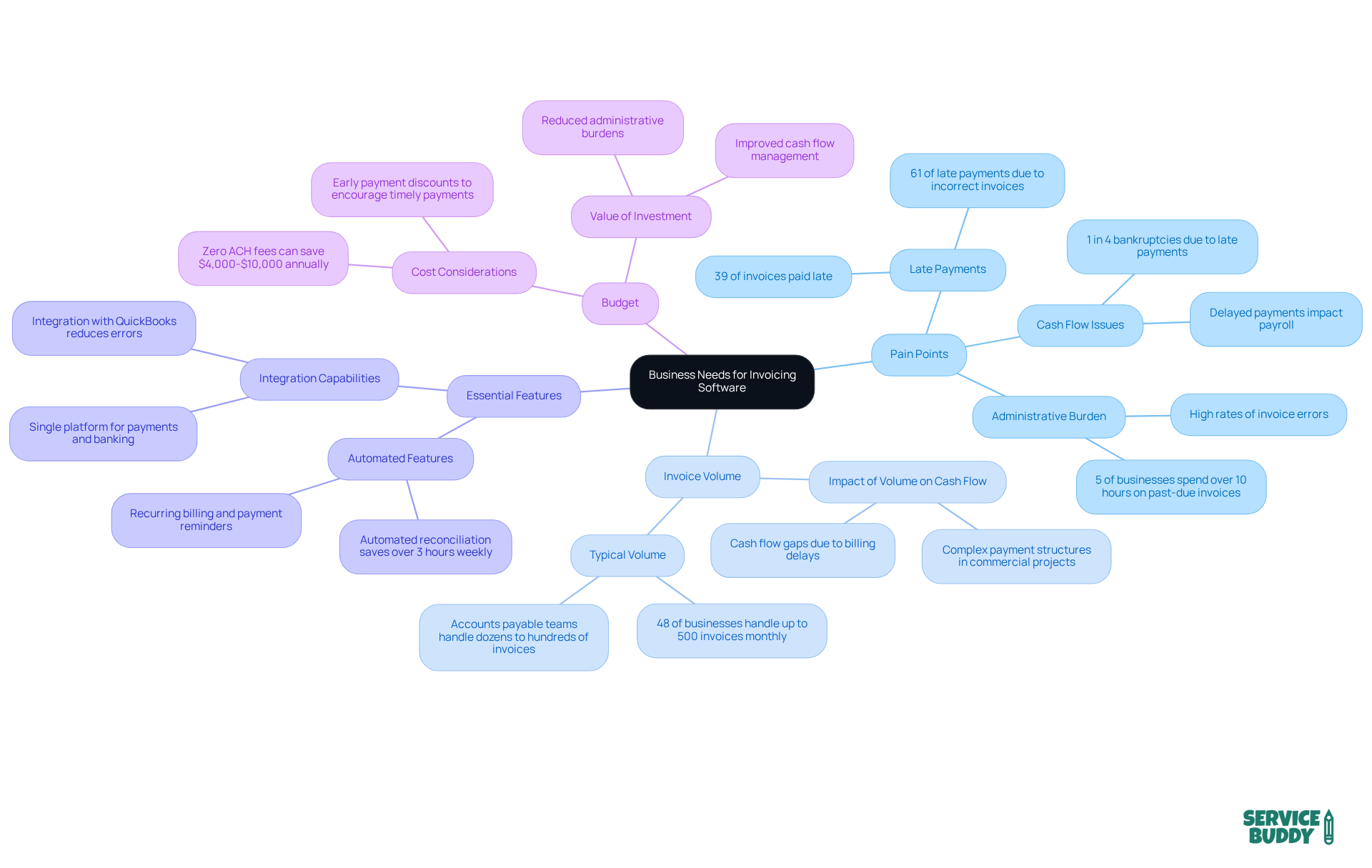

Begin by evaluating your current invoicing process with these key considerations:

-

Identify Pain Points: What are the main challenges in your invoicing system? Delays, errors, and inadequate tracking can hinder your operations. For instance, did you know that 39% of invoices in the U.S. are paid late? Often, this is due to invoice inaccuracies, which can significantly impact cash flow. Notably, 61% of late payments stem from incorrect invoices, underscoring the critical need for accuracy in your invoicing system.

-

Assess Invoice Volume: How many invoices does your company generate monthly? Flooring companies typically handle a substantial volume, with many managing up to 500 invoices each month. In fact, almost half of all businesses (48%) handle up to 500 invoices monthly. Understanding your average invoice value is also crucial for effective financial planning.

-

Consider Essential Features: Do you need functionalities like recurring billing, automated payment reminders, or seamless integration with accounting tools like QuickBooks? These features of simple invoicing software can simplify your billing process and reduce administrative burdens. Moreover, automated reconciliation can save more than 3 hours weekly on bookkeeping, highlighting the efficiency improvements possible through effective billing tools.

-

Evaluate Your Budget: What’s your budget for billing applications? With options available that offer zero ACH fees and no hidden costs, it’s essential to find a solution that aligns with your financial capabilities while meeting your operational needs. Additionally, consider the potential for early payment discounts as a strategy to encourage clients to pay early.

Recording your answers to these questions will provide a clear understanding of your billing needs, allowing you to assess possible application solutions efficiently. By addressing these aspects, you can enhance your billing efficiency with simple invoicing software and ultimately improve your cash flow management.

Evaluate Essential Features for Flooring Industry

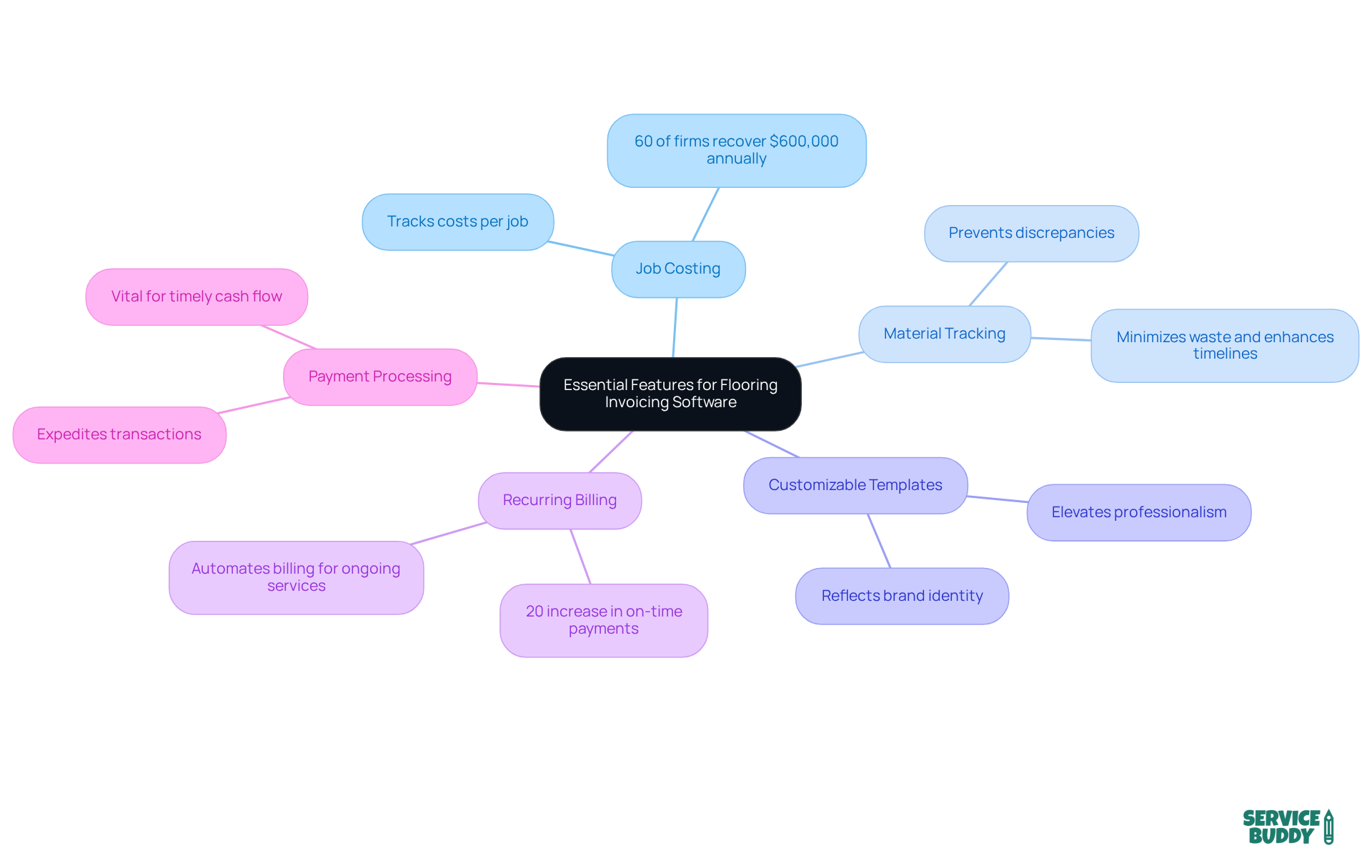

When selecting simple invoicing software for your flooring company, it’s crucial to focus on features that enhance operational efficiency and accuracy. Here are key characteristics to consider:

- Job Costing: This feature enables you to track costs associated with each job, ensuring precise invoicing and profitability analysis. Companies that implement job costing can significantly improve their financial management; in fact, 60% of firms report recovering an average of $600,000 annually after adopting automated billing systems.

- Material Tracking: Keeping tabs on inventory and materials used for each project helps prevent discrepancies and guarantees that you have the necessary supplies readily available. Effective material tracking can minimize waste and enhance project timelines.

- Customizable Templates: Design professional invoices that reflect your brand identity. Custom templates not only elevate your company’s professionalism but also positively influence client perceptions.

- Recurring Billing: Automate billing for ongoing services or maintenance contracts to streamline cash flow and lessen administrative burdens. Businesses that utilize automated billing often experience a 20% increase in on-time payments, demonstrating how these features can enhance cash flow.

- Payment Processing: Integrated payment options expedite transactions, allowing you to receive payments more swiftly. This is especially vital in the flooring industry, where timely payments can greatly affect cash flow.

Evaluate and prioritize these features based on your organizational goals to select the simple invoicing software that aligns with your specific needs and enhances productivity in your operations.

Compare Available Simple Invoicing Software Solutions

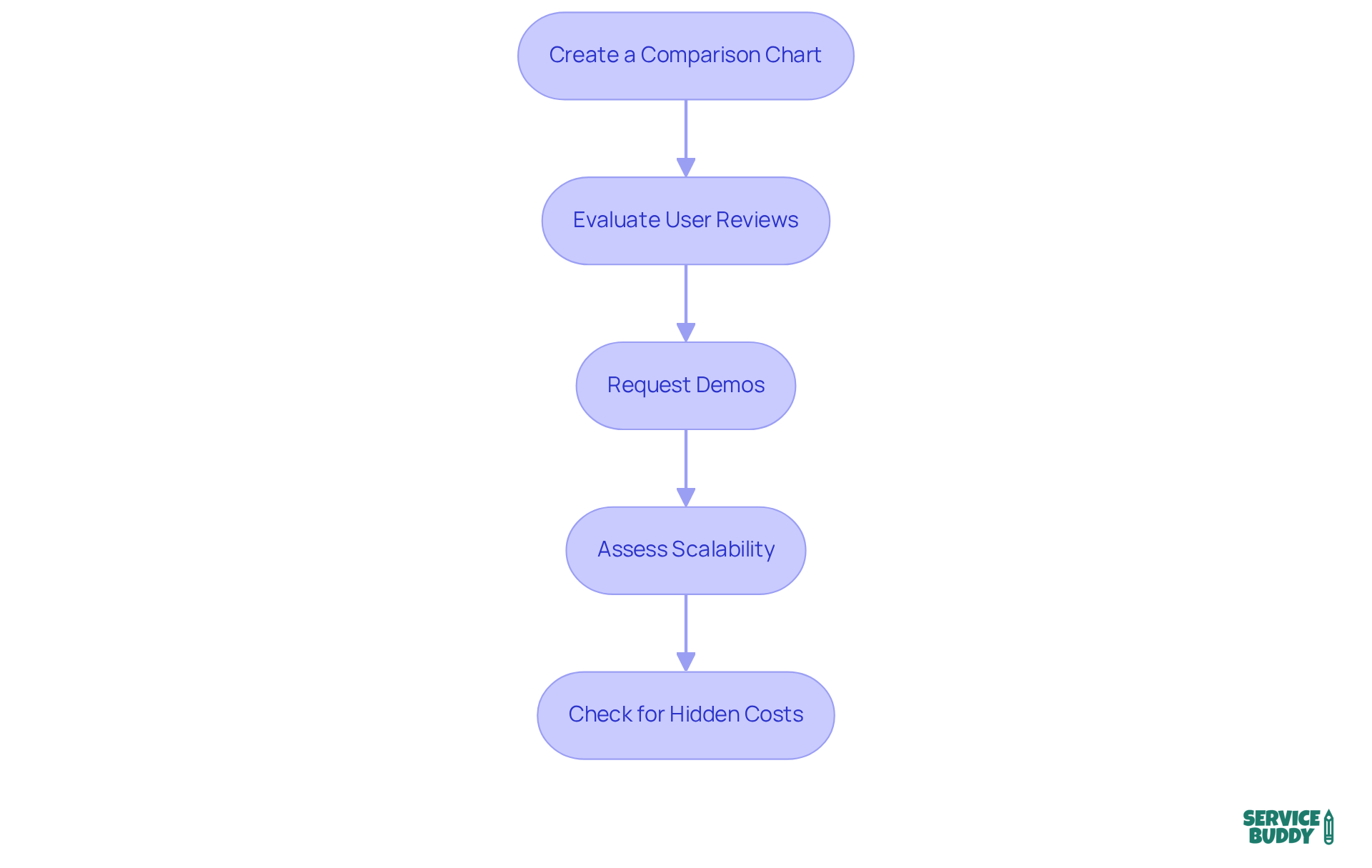

To effectively compare invoicing software solutions for your flooring business, follow these essential steps:

-

Create a Comparison Chart: Start by listing potential program options, detailing their features, pricing structures, and user reviews. This visual representation helps you quickly identify the strengths and weaknesses of each option.

-

Evaluate User Reviews: Seek feedback from other flooring companies to assess satisfaction levels and performance metrics. Did you know that businesses using simple invoicing software report a 50% enhancement in efficiency? User insights are crucial in this evaluation.

-

Request Demos: Take advantage of free trials or demonstrations offered by application providers. Experiencing the application firsthand allows you to assess its usability and functionality in real-world scenarios.

-

Assess Scalability: Ensure that the software can adapt to your expanding organizational needs. Look for solutions that offer flexible pricing plans and additional features that can be integrated as your operations grow.

-

Check for Hidden Costs: Be vigilant about any additional fees associated with features or customer support. Understanding the total cost of ownership will help you avoid unexpected expenses down the line.

By systematically evaluating these choices, you can make a knowledgeable decision that aligns with your enterprise objectives and enhances your billing processes through simple invoicing software.

Consider Integration Capabilities with Existing Tools

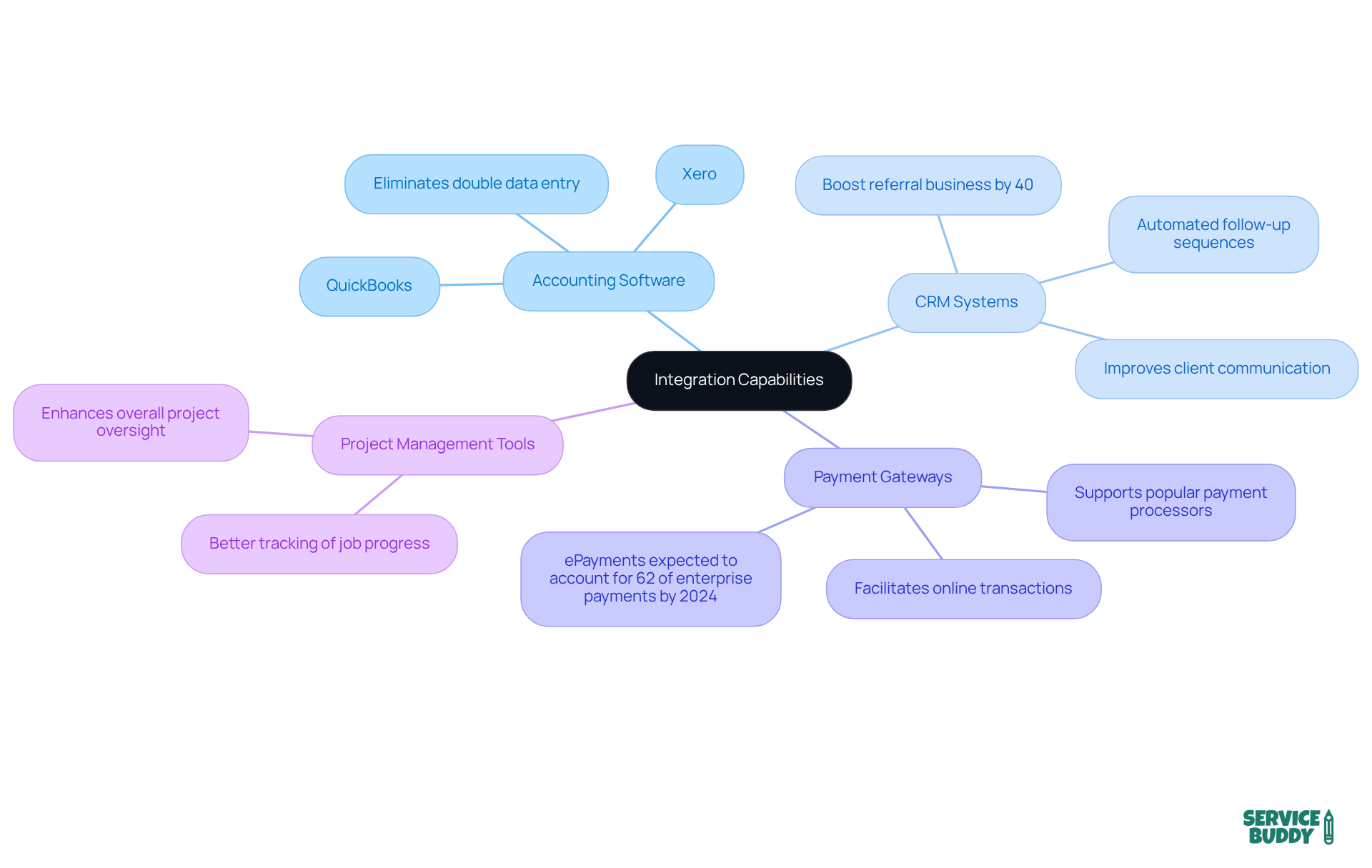

When evaluating billing applications for your flooring company, integration features are crucial for optimizing operations. Let’s explore some key aspects:

- Accounting Software: It’s vital that your invoicing solution integrates seamlessly with existing accounting tools like QuickBooks or Xero. This integration streamlines financial management and eliminates the hassle of double data entry.

- CRM Systems: Compatibility with customer relationship management applications is essential for improving client communication and tracking interactions. In fact, effective CRM integration can boost referral business by up to 40%, as demonstrated by successful flooring companies that leverage automated follow-up sequences.

- Payment Gateways: Ensure the application supports popular payment processors to facilitate online transactions and enhance cash flow management. The rise of ePayments is transforming transactions, driven by the demand for faster, more secure, and convenient payment options. By 2024, ePayments are expected to account for 62% of all enterprise payments.

- Project Management Tools: Integration with project management applications allows for better tracking of job progress and expenses, ultimately enhancing overall project oversight.

Thoroughly assess how well each invoicing option integrates with your current tools. This evaluation is key to ensuring a smooth workflow and maximizing efficiency in your operations.

Assess User Experience and Customer Support Options

User Interface: Choose software that boasts an intuitive design. This not only reduces the learning curve for your team but also facilitates quicker adoption and boosts efficiency.

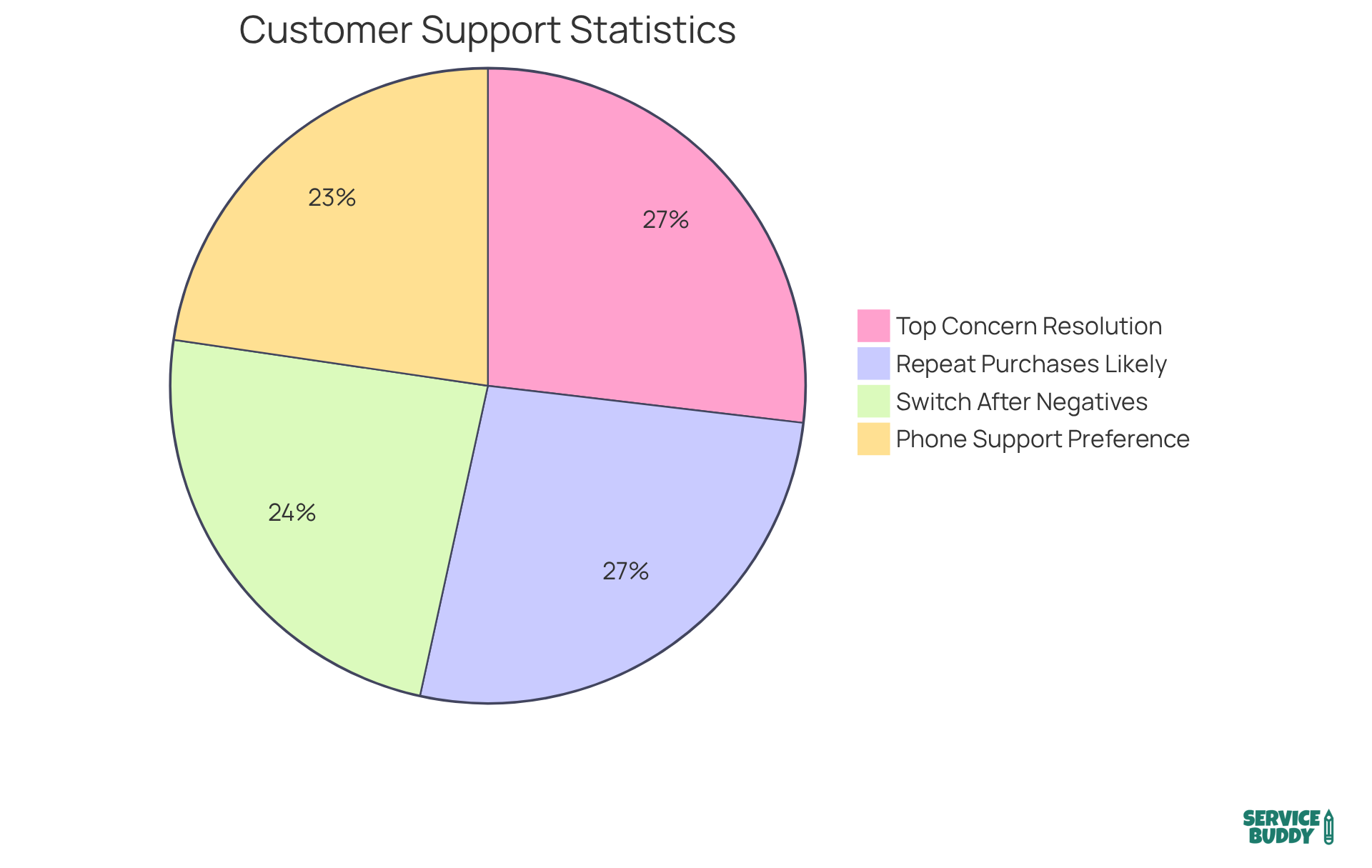

Customer Support: Assess the variety of support options available—think live chat, phone support, and email—and their responsiveness. Did you know that 76% of consumers prefer phone support? This statistic underscores the importance of traditional communication methods alongside modern options. Moreover, 80% of consumers are likely to switch to a competitor after a few negative experiences, emphasizing how crucial support is in retaining clients. Additionally, 90% of consumers view issue resolution as their top customer service concern, reinforcing the necessity for effective support.

Training Resources: Look into the availability of comprehensive training materials, such as tutorials, webinars, and documentation. These resources can significantly aid users in navigating the application effectively.

Community Feedback: Delve into user forums and groups to understand how others perceive the support and usability of the application. Positive community feedback often serves as a strong indicator of reliability and effectiveness.

A seamless user experience, paired with robust client support, is vital for enhancing your invoicing process and ensuring overall satisfaction with the simple invoicing software. Consider this: 89% of consumers are inclined to make repeat purchases after a positive service experience, and 93% are likely to return to companies that deliver outstanding service. Investing in these areas can lead to increased loyalty and business growth. On the flip side, 78% of customers have abandoned a purchase due to a poor customer experience, highlighting the serious consequences of inadequate support.

Conclusion

Mastering simple invoicing software is crucial for flooring businesses aiming to boost operational efficiency and improve cash flow management. By understanding their specific needs, evaluating key features, and comparing available solutions, flooring contractors can streamline invoicing processes and reduce the challenges tied to billing inaccuracies.

Consider critical factors like:

- Identifying pain points in your current invoicing system

- Assessing the volume of invoices generated

- Prioritizing essential features such as job costing and material tracking

- Integration capabilities with existing tools

- User experience

- Customer support options

These elements collectively contribute to a more efficient and effective invoicing process.

Investing time in selecting the right invoicing software goes beyond just improving billing accuracy; it positions your business for long-term success. By leveraging these insights, flooring companies can make informed decisions that enhance productivity and foster better cash flow management. Embrace the potential of simple invoicing software to transform your operations and achieve greater financial stability.

Frequently Asked Questions

What should I consider when identifying my business needs for invoicing software?

You should evaluate pain points in your current invoicing process, assess your invoice volume, consider essential features needed, and evaluate your budget for billing applications.

What are common challenges in invoicing systems?

Common challenges include delays, errors, and inadequate tracking, which can hinder operations. A significant portion of invoices are paid late due to inaccuracies, impacting cash flow.

How many invoices do typical flooring companies handle monthly?

Many flooring companies manage up to 500 invoices each month, with almost half of all businesses handling this volume.

What essential features should I look for in invoicing software?

Key features to consider include job costing, material tracking, customizable templates, recurring billing, and integrated payment processing.

How does job costing benefit a flooring company?

Job costing allows tracking of costs associated with each job, leading to precise invoicing and improved profitability analysis. Companies using this feature can recover significant amounts annually after adopting automated billing systems.

Why is material tracking important?

Material tracking helps prevent discrepancies and ensures necessary supplies are available, minimizing waste and enhancing project timelines.

How can customizable templates impact my invoicing?

Customizable templates allow you to design professional invoices that reflect your brand identity, which can positively influence client perceptions.

What advantages does recurring billing offer?

Recurring billing automates invoicing for ongoing services, streamlining cash flow and reducing administrative burdens, often resulting in a 20% increase in on-time payments.

How does integrated payment processing benefit my business?

Integrated payment options expedite transactions, allowing for quicker receipt of payments, which is crucial for maintaining cash flow in the flooring industry.

How can I effectively assess my invoicing needs?

By recording answers to the key considerations mentioned, you can gain a clear understanding of your billing needs and evaluate potential application solutions efficiently.